| 原文链接》》 The yuan joins the SDR 人民币“入蓝” Maiden voyage 软妹币的“第一次” Reserve-currency status might make for aweaker yuan 储币地位或令人民币贬值 Dec 5th 2015 | From the print edition  由于苏伊士运河已于今年八月扩建完毕(2015年8月6日新苏伊士运河正式开通,此处应指新运河),从今年早些时候起,渡过运河变得容易了许多。现在它的结构变得更为复杂了。该运河的过境费是以国际货币基金组织(IMF)的特别提款权作为计价的——它是以一揽子货币作为其记账单位的。本周,IMF决定从明年起接纳人民币“入蓝”,“篮子”里已有的货币包括美元、欧元、英镑和日元。 2.If lots of things were priced in SDRs, the IMF’s decisionwould have forced companies around the world to buy yuan-denominated assets assoon as possible, to hedge their exposure. That would have prompted China’scurrency to strengthen dramatically. But few goods or services are priced inSDRs. Instead, admission to the currency club is significant mainly for itssymbolism: the IMF is lending its imprimatur to the yuan as a reservecurrency—a safe, liquid asset in which governments can park theirwealth. Indeed, far from setting off a groundswell of demand for the yuan,the IMF’s decision may pave the way for its depreciation. 因为许多事务都是以特别提款权作为定价的,IMF的决定迫使全球许多公司要尽快地购买以人民币计价的资产,以此来对冲风险。这将促使人民币大幅升值。但是很少有商品或是服务是以特别提款权作为定价的。相反,加入货币俱乐部更多地具有象征意义:IMF正式批准人民币成为一种储备货币——使其成为一种可令各国政府安心寄放的安全、流动的资产。事实上,IMF的决定可能事与愿违,会令对人民币的需求降温,使人民币贬值。 3.The reason isthat the People’s Bank of China (PBOC) will now find itself under more pressureto manage the yuan as central banks in most rich economies do theircurrencies—by letting market forces determine their value. In bringing the yuaninto the SDR, the IMF had to determine that it is “freely usable”. Beforecoming to this decision, the IMF asked China to make changes to its currencyregime. 原因是中国人民银行(PBOC)会发现自己将承受更大的压力来管控人民币,如同世界上大多数富裕经济体的央行管控它们的货币一样——由市场来决定货币的价值。人民币“入蓝”,IMF必须确定它是能“自由使用”的。在做出决定之前,IMF会要求中国政府改变其现有是汇率机制。 4.Most importantly, China has now tied the yuan’s exchangerate at the start of daily trading to the previous day’s close; in the past thestarting quote was in effect set at the whim of the PBOC, often creating a biggap with the value at which it last traded. It was the elimination of this gapthat lay behind the yuan’s 2% devaluation in August, a move that rattled globalmarkets. Though the yuan is still far from being a free-floating currency—thecentral bank has intervened since August to prop it up—the cost of suchintervention is now higher. The PBOC must spend real money during the tradingday to guide the yuan to its desired level. 最重要的是,中国现行的每日汇率其开盘价是与前一交易日的收盘价相挂钩的。而之前的开拍价事实上是由中国央行任意确定的,往往会与最终交易价产生较大差价。为了消除这一差价,八月时人民币贬值2%,此举曾令全球市场惊愕不已。然而人民币离成为自由浮动货币为时尚早——自八月以来中国央行开始进行干预支持,目前这种干预成本变得更高了。中国央行必须把钱花在刀刃上,用以指导人民币的交易价维持在其期许值以内。 5.Inclusion in theSDR will only deepen the expectations that China will let market forces decidethe yuan’s exchange rate. The point of the SDR is to weave disparate currenciestogether into a single, diversified unit; some have suggested, for example,that commodities be quoted in SDRs to reduce the volatility of pricing them indollars. But if China maintains its de facto peg to the dollar, the result ofadding the yuan to the SDR will be to boost the dollar’s weight in the basket,defeating the point. 纳入特别提款权只会加深中国想让市场来决定人民币汇率的期许。特别提款权将不同的货币交织成为一种单一、多元的计价单位;比如说,有人建议将商品引入特别提款权以减少因美元波动而影响其价格。但如果中国要是继续紧盯美元不放,那么人民币“入蓝”将会令美元币值暴增,一家独大,打破“篮子”里原有的平衡。 6.What would happen if China really did give the market the last word on theyuan? For some time it has been under downward pressure. The simplest yardstickis the decline in China’s foreign-exchange reserves, from a peak of nearly $4trillion last year to just over $3.5 trillion now—a reflection, in part, of thePBOC’s selling of dollars to support the yuan. Were it not for tighter capitalcontrols since the summer, outflows might have been even bigger. 如果中国真的给了人民币踏入市场前的临行忠告,那么将会发生什么呢?人民币将会有一段时间的下行压力。最简单的衡量标准就是中国的外汇储备在下降,从去年顶峰时的4兆美元到如今的勉强3.5兆美元——这就是反应。某种程度上,中国央行在抛售美元来支撑人民币。若不是今夏以来更为严格的资金管控,恐怕外流的外汇会更多。 7.And the yuandoes look overvalued. Despite China’s slowing economy, its continued link tothe surging dollar has put it near an all-time high in trade-weighted terms, upby more than 13% in the past 18 months (see chart). With the Federal Reservegearing up to start raising interest rates at the same time as China isloosening its monetary policy, the yuan looks likely to come under moredownward pressure, at least against the dollar. 人民币被高估了。尽管中国经济放缓,但人民币继续与飙升的美元相挂钩,使其接近了贸易加权计算的历史高位,在过去的18个月里,同比增长超过13%(见本文图表)。在美联储加紧启动提高利率的同时,中国放松了其货币政策,人民币兑美元可能至少会承受更多的下行压力。 8.It would be foolhardy to predict that China will suddenlygive the market free rein. That would go against its deep-seated preference forgradual reform. But while basking in the glow of its SDR status, China mustalso be aware of the responsibility to minimise intervention that comes withit. A weaker yuan may well be the result. 中国会突然给市场以自由发挥的空间可能是鲁莽的预测。那将会违背中国进行渐进式深入改革的“心头好”。沉浸于特别提款权的荣光中,中国必须意识到对人民币干预最小化的责任也随之而来了。其结果可能会出现一个势弱的人民币(人民币贬值)。 From the print edition: Finance and economics |

JudyLucy0321 发表于 2015-12-4 07:26

可问题是我新号无法在我原本发报纸的板块回帖,大号被禁言,而且我们板块4个版主被禁了2个

已经无计可施了 ...

abc999good 发表于 2015-12-4 08:12

Honey,there,there.Everything will be fine.

coolfool 发表于 2015-12-29 14:58

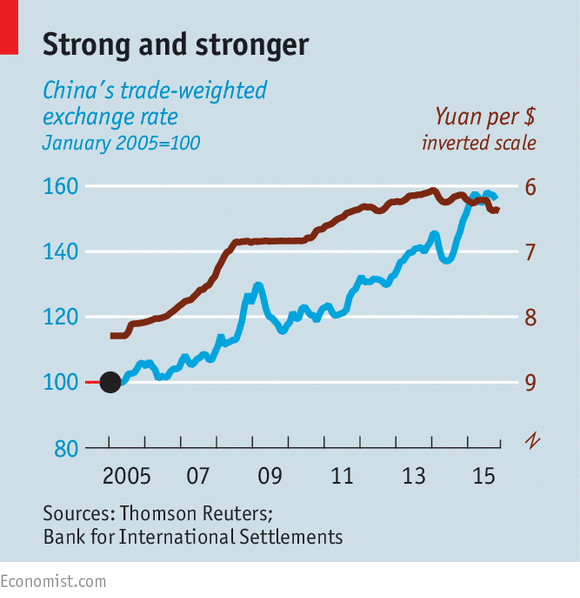

Text: This week the IMF decided toinclude [sic, should be to include] the yuan in the basket from ne ...

abc999good 发表于 2016-1-1 10:47

受教了,可以看出您是一位非常严谨认真的人,已申请加您为好友,如若方便,可否留个QQ或是微信?方便随 ...

coolfool 发表于 2016-1-1 13:18

My comments are for discussion only. Criticisms are always welcome.

Sorry I have neither QQ nor m ...

|网站地图|手机版|小黑屋|关于我们|ECO中文网

( 京ICP备06039041号 )

|网站地图|手机版|小黑屋|关于我们|ECO中文网

( 京ICP备06039041号 )

GMT+8, 2026-1-7 10:53 , Processed in 0.077400 second(s), 26 queries .

Powered by Discuz! X3.5

© 2001-2025 Discuz! Team.